Why Are Property Taxes Based On Value . property tax is levied on real estate owners in india by state governments. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. In hyderabad, ghmc determines tax based on rental. capital value system (cvs): property tax is imposed by local governments on property owners, based on the assessed value of their properties. Property tax rates directly affect property values. the municipal corporation in any area is responsible for assessing the value of a property and it is based on this. Higher taxes can lead to decreased property values as buyers. This market value is determined. The tax is levied as a percentage of the market value of the property. several factors lead to low property tax revenue in india: Undervaluation, incomplete registers, policy inadequacy, and. It serves as a vital source of revenue.

from www.quickenloans.com

property tax is levied on real estate owners in india by state governments. It serves as a vital source of revenue. Higher taxes can lead to decreased property values as buyers. The tax is levied as a percentage of the market value of the property. This market value is determined. the municipal corporation in any area is responsible for assessing the value of a property and it is based on this. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. several factors lead to low property tax revenue in india: Undervaluation, incomplete registers, policy inadequacy, and. In hyderabad, ghmc determines tax based on rental.

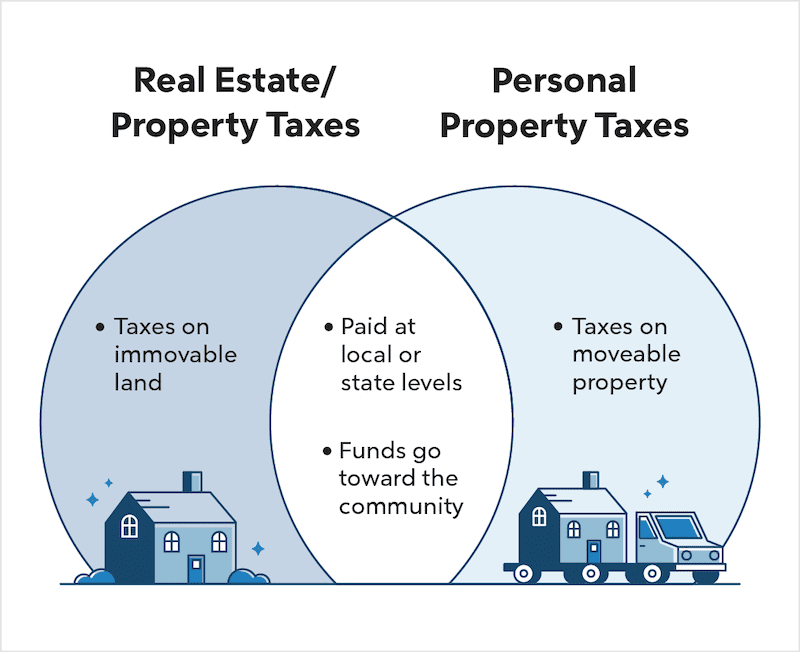

Real Estate Taxes Vs. Property Taxes Quicken Loans

Why Are Property Taxes Based On Value property tax is levied on real estate owners in india by state governments. Property tax rates directly affect property values. several factors lead to low property tax revenue in india: property tax is levied on real estate owners in india by state governments. property tax is imposed by local governments on property owners, based on the assessed value of their properties. The tax is levied as a percentage of the market value of the property. Undervaluation, incomplete registers, policy inadequacy, and. capital value system (cvs): This market value is determined. It serves as a vital source of revenue. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. In hyderabad, ghmc determines tax based on rental. the municipal corporation in any area is responsible for assessing the value of a property and it is based on this. Higher taxes can lead to decreased property values as buyers.

From blog.turbotax.intuit.com

Real Estate Taxes vs. Property Taxes Intuit TurboTax Blog Why Are Property Taxes Based On Value This market value is determined. In hyderabad, ghmc determines tax based on rental. Higher taxes can lead to decreased property values as buyers. It serves as a vital source of revenue. capital value system (cvs): property tax is levied on real estate owners in india by state governments. the municipal corporation in any area is responsible for. Why Are Property Taxes Based On Value.

From www.reddit.com

Property tax versus land value tax (LVT) illustrated Why Are Property Taxes Based On Value Undervaluation, incomplete registers, policy inadequacy, and. the municipal corporation in any area is responsible for assessing the value of a property and it is based on this. It serves as a vital source of revenue. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. property. Why Are Property Taxes Based On Value.

From slideplayer.com

Paying for a Public Externality ppt download Why Are Property Taxes Based On Value property tax is imposed by local governments on property owners, based on the assessed value of their properties. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. property tax is levied on real estate owners in india by state governments. The tax is levied as. Why Are Property Taxes Based On Value.

From www.aspentimes.com

How to understand the property valuation notices and what it will mean Why Are Property Taxes Based On Value the municipal corporation in any area is responsible for assessing the value of a property and it is based on this. capital value system (cvs): This market value is determined. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. property tax is imposed by. Why Are Property Taxes Based On Value.

From lao.ca.gov

Understanding California’s Property Taxes Why Are Property Taxes Based On Value property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. property tax is levied on real estate owners in india by state governments. the municipal corporation in any area is responsible for assessing the value of a property and it is based on this. It serves. Why Are Property Taxes Based On Value.

From www.fox21online.com

Duluth's Council Approves 8.9 Increase In Property Tax Levy Why Are Property Taxes Based On Value capital value system (cvs): This market value is determined. several factors lead to low property tax revenue in india: Property tax rates directly affect property values. Higher taxes can lead to decreased property values as buyers. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,.. Why Are Property Taxes Based On Value.

From edgertonks.org

Understanding Property Taxes City of Edgerton, Kansas Why Are Property Taxes Based On Value property tax is imposed by local governments on property owners, based on the assessed value of their properties. Higher taxes can lead to decreased property values as buyers. Undervaluation, incomplete registers, policy inadequacy, and. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. the municipal. Why Are Property Taxes Based On Value.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Why Are Property Taxes Based On Value In hyderabad, ghmc determines tax based on rental. Property tax rates directly affect property values. capital value system (cvs): This market value is determined. It serves as a vital source of revenue. several factors lead to low property tax revenue in india: Undervaluation, incomplete registers, policy inadequacy, and. property tax is imposed by local governments on property. Why Are Property Taxes Based On Value.

From www.meganmicco.com

Property Taxes & Supplemental Tax Bill Key Dates Why Are Property Taxes Based On Value In hyderabad, ghmc determines tax based on rental. Higher taxes can lead to decreased property values as buyers. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. the municipal corporation in any area is responsible for assessing the value of a property and it is based. Why Are Property Taxes Based On Value.

From retipster.com

What Is Property Tax? Why Are Property Taxes Based On Value This market value is determined. The tax is levied as a percentage of the market value of the property. Undervaluation, incomplete registers, policy inadequacy, and. Higher taxes can lead to decreased property values as buyers. capital value system (cvs): property tax is an annual charge levied by the government on property owners based on various factors such as. Why Are Property Taxes Based On Value.

From montanafreepress.org

How Montana property taxes are calculated Why Are Property Taxes Based On Value This market value is determined. capital value system (cvs): It serves as a vital source of revenue. Property tax rates directly affect property values. property tax is levied on real estate owners in india by state governments. The tax is levied as a percentage of the market value of the property. the municipal corporation in any area. Why Are Property Taxes Based On Value.

From www.hippo.com

Your Guide to Property Taxes Hippo Why Are Property Taxes Based On Value Undervaluation, incomplete registers, policy inadequacy, and. several factors lead to low property tax revenue in india: property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. The tax is levied as a percentage of the market value of the property. In hyderabad, ghmc determines tax based on. Why Are Property Taxes Based On Value.

From www.youtube.com

Understanding Your Property Taxes and Values YouTube Why Are Property Taxes Based On Value property tax is imposed by local governments on property owners, based on the assessed value of their properties. property tax is levied on real estate owners in india by state governments. Property tax rates directly affect property values. the municipal corporation in any area is responsible for assessing the value of a property and it is based. Why Are Property Taxes Based On Value.

From storeys.com

Homeowners Continue to Pay Property Taxes Based on 2016 Values Why Are Property Taxes Based On Value This market value is determined. property tax is imposed by local governments on property owners, based on the assessed value of their properties. property tax is levied on real estate owners in india by state governments. The tax is levied as a percentage of the market value of the property. Higher taxes can lead to decreased property values. Why Are Property Taxes Based On Value.

From www.youtube.com

Are property taxes based on market values for all property types in Why Are Property Taxes Based On Value property tax is levied on real estate owners in india by state governments. property tax is an annual charge levied by the government on property owners based on various factors such as location, type,. Undervaluation, incomplete registers, policy inadequacy, and. several factors lead to low property tax revenue in india: Property tax rates directly affect property values.. Why Are Property Taxes Based On Value.

From jenniferyoingcorealtor.com

Assessed Value vs Market Value How To Calculate Market Value of Why Are Property Taxes Based On Value capital value system (cvs): It serves as a vital source of revenue. property tax is imposed by local governments on property owners, based on the assessed value of their properties. Property tax rates directly affect property values. property tax is an annual charge levied by the government on property owners based on various factors such as location,. Why Are Property Taxes Based On Value.

From www.wxyz.com

How MI property taxes are calculated and why your bills are rising Why Are Property Taxes Based On Value property tax is levied on real estate owners in india by state governments. In hyderabad, ghmc determines tax based on rental. Property tax rates directly affect property values. property tax is imposed by local governments on property owners, based on the assessed value of their properties. It serves as a vital source of revenue. This market value is. Why Are Property Taxes Based On Value.

From www.expressnews.com

Bexar property bills are complicated. Here’s what you need to know. Why Are Property Taxes Based On Value The tax is levied as a percentage of the market value of the property. property tax is imposed by local governments on property owners, based on the assessed value of their properties. Undervaluation, incomplete registers, policy inadequacy, and. several factors lead to low property tax revenue in india: This market value is determined. property tax is an. Why Are Property Taxes Based On Value.